IMARC Group has recently released a new research study titled “Mexico Insulin Pumps Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033,” which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Mexico Insulin Pumps Market Overview

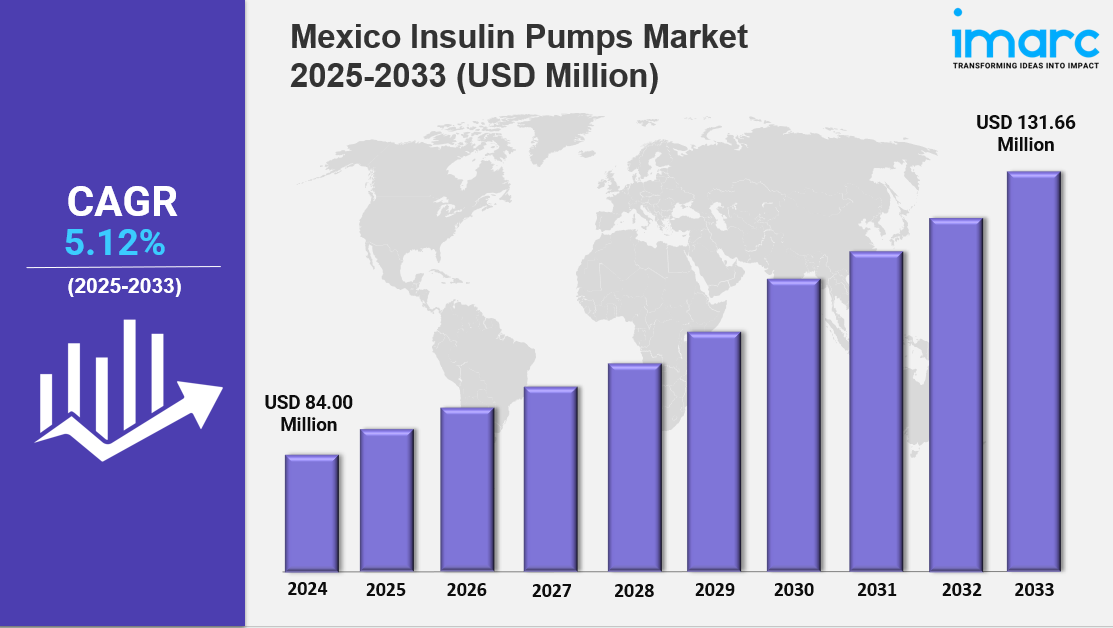

The Mexico insulin pumps market size reached USD 84.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 131.66 Million by 2033, exhibiting a growth rate (CAGR) of 5.12% during 2025-2033.

Market Size and Growth

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 84.00 Million

Market Forecast in 2033: USD 131.66 Million

Market Growth Rate 2025-2033: 5.12%

Request for a sample copy of the report: https://www.imarcgroup.com/mexico-insulin-pumps-market/requestsample

Key Market Highlights:

✔️ Rising diabetes prevalence fueling demand for advanced insulin delivery solutions

✔️ Growing awareness and adoption of wearable diabetes management technologies

✔️ Supportive government healthcare initiatives and increasing private sector investments

Mexico Insulin Pumps Market Trends

Advanced technologies like artificial intelligence (AI) and continuous glucose monitoring (CGM) integration are redefining insulin therapy in Mexico. Global leaders such as Medtronic, Tandem Diabetes Care, and Insulet are deploying hybrid closed-loop systems in partnership with local institutions. Notably, Medtronic piloted its MiniMed 780G system with Mexico City’s National Institute of Medical Sciences in 2024, targeting a 30% reduction in hypoglycemic events among 1,200 patients.

Startups like Clínicas Tech and GluCare are fueling the digital transformation through AI-powered mobile apps that sync with pumps and deliver real-time dietary guidance. These innovations contributed to a 45% year-on-year increase in insulin pump adoption among urban millennials, a clear indicator of evolving Mexico Insulin Pumps Market Trends.

Market Barriers: Cost and Infrastructure Disparities

Access Challenges Impacting the Mexico Insulin Pumps Market Growth

Despite these advances, high device costs—averaging MXN60,000 per unit—remain a major obstacle for low-income populations. While companies like Novo Nordisk have introduced installment plans, limited access in rural areas persists. Only 18% of clinics outside major cities stock insulin pump supplies, forcing patients to travel long distances for basic maintenance.

This gap threatens to widen health inequities, even as the Mexico Insulin Pumps Market Growth potential remains strong. According to the Mexican Association of Diabetes, over 14.6 million adults are currently living with diabetes, translating into a USD 1.2 billion addressable market for insulin pump manufacturers and service providers.

Government-Led Initiatives Driving Market Expansion

In 2024, Mexico’s Ministry of Health revised NOM-015-SSA3-2022, reclassifying insulin pumps as “essential medical devices.” This critical change made pumps eligible for reimbursement under the Seguro Popular public insurance program, giving 23,000 Type 1 diabetics access to subsidized devices within the first year and slashing out-of-pocket costs by up to 70%.

International cooperation is also growing. The U.S.-Mexico Diabetes Innovation Alliance committed USD 50 million in 2024 for medical training programs, benefiting over 5,000 endocrinologists and nurses. Meanwhile, private insurers like GNP and AXA introduced tiered premium plans with pump subsidies, capturing 38% of the middle-income market segment.

Insulin pump usage is no longer confined to urban elites. Pediatric demand rose 62% since 2023, driven by advocacy organizations like Con Diabetes Sí Se Puede, which are campaigning for diabetic-friendly school environments. In response, Roche Diabetes Care launched the Accu-Chek Solo in 2024—a Spanish-language pump priced 40% lower than competitors, tailored to households earning MXN10,000–15,000 monthly.

Supply chain improvements are playing a key role. Jabil Healthcare established a USD 120 million assembly plant in Querétaro, cutting insulin pump import costs by 22% and reducing delivery times to just three days. Still, regional and cultural disparities endure. Many rural patients (38%) remain wary of automated therapy, preferring traditional insulin injections. Language barriers—particularly for the 16 indigenous languages that lack pump interface translations—compound this issue, limiting telehealth adoption in underserved regions.

Digital Health Security and Future Outlook

The Mexico Insulin Pumps Market Trends point toward greater digitization. AI-enabled platforms like Tandem’s t:slim X2, now embedded with Mexico-specific glycemic algorithms based on local diets, are becoming more common. In 2024, COFEPRIS fast-tracked Eversense’s 365-day CGM-pump combo, though access remains limited to private-sector clinics.

Public programs are stepping up. The National Diabetes Prevention Program allocated MXN 2.3 billion in 2024 to provide insulin pumps for indigenous communities. However, logistical hurdles mean only 9% of distributed devices reached their intended users.

Domestic production is easing reliance on foreign imports, now covering 41% of pump components. However, cybersecurity remains a looming threat. A 2024 breach of Omnipod’s Mexico server compromised data from 8,000 users, sparking new regulatory discussions between Mexico and the FDA on IoT medical device security.

Market Forecast: Growth Anchored in Innovation and Inclusion

The Mexico Insulin Pumps Market is projected to reach USD 650 million by 2026, propelled by:

- Demographic shifts, including aging and obesity-driven diabetes cases.

- Accelerated domestic manufacturing.

- Expanding public-private healthcare partnerships.

- Increased technological adoption across socioeconomic segments.

However, success will depend on the country’s ability to balance premium medical innovation with grassroots accessibility. As climate change and metabolic disorders intersect, the demand for intelligent, accessible diabetes care will only increase—cementing Mexico’s role as a strategic player in Latin America’s digital health transformation.

Mexico Insulin Pumps Market Segmentation:

The market report segments the market based on product type, distribution channel, and region:

Breakup by Product Type:

- Insulin Pumps

- Tethered Pumps

- Disposable/Patch Insulin Pumps

- Insulin Pump Supplies and Accessories

- Infusion Set Insertion Devices

- Insulin Reservoirs/Cartridges

Breakup by Distribution Channel:

- Hospital Pharmacy

- Retail Pharmacy

- Online Sales

- Diabetes Clinics/Centers

- Others

Breakup by Region:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Ask Analyst & Browse Full Report with TOC & List of Figures: https://www.imarcgroup.com/request?type=report&id=36781&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2019-2024)

2. Market Outlook (2025-2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91-120-433-0800

United States: +1 201971-6302