SharkShop’s Credit Score Strategies: Boost Your Score Without Stress

Welcome to SharkShop.biz ultimate guide on credit score strategies that will have you swimming in confidence! If the mere mention of your credit score makes your heart race, you’re not alone. Many people feel overwhelmed by the complexities of credit management—but it doesn’t have to be this way! In this post, we’ll dive deep into stress-free techniques that can help boost your credit score without breaking a sweat.

Whether you’re aiming for that dream home, planning to finance a new car, or simply want to improve your financial health, our expert tips are designed with you in mind. Say goodbye to confusion and hello to empowerment as we navigate through proven strategies tailored for every budget and lifestyle. Let’s get started on transforming those digits into a reflection of your true potential!

Introduction to Credit Scores and Why They Matter

Your credit score isn’t just a number; it’s your financial passport. It unlocks doors to better interest rates, loan approvals, and even rental opportunities. But navigating the world of credit can feel overwhelming and stressful. That’s where SharkShop comes in! With expert insights and practical strategies, you can boost your score without breaking a sweat.

Imagine having the power to increase your creditworthiness while staying calm and collected. SharkShop.biz is here to guide you through simple yet effective steps that will transform how lenders view you. Say goodbye to confusion and hello to confidence as we dive into easy ways to enhance your credit profile! Let’s get started on this journey toward financial empowerment together.

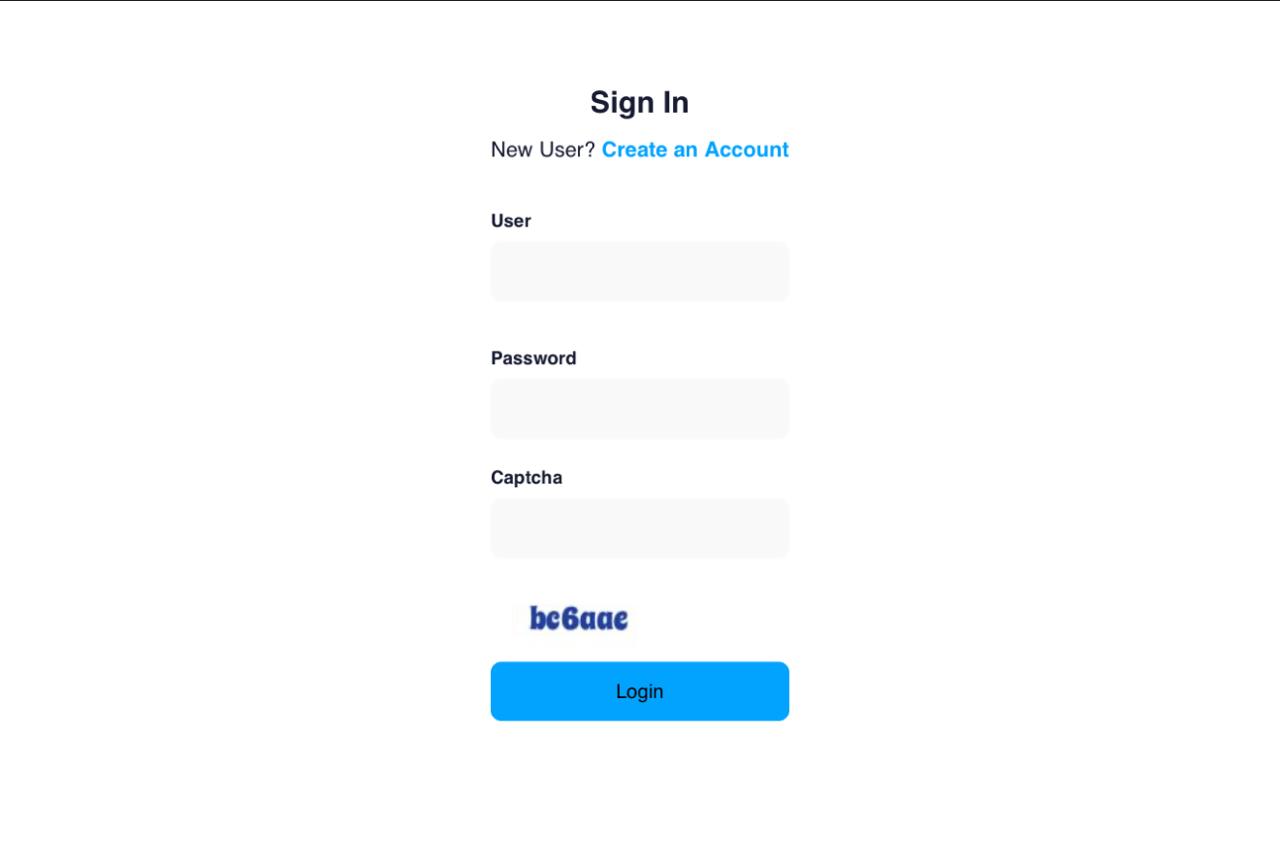

A Screenshot of Sharkshop (Sharkshop.biz) login page

Understanding the Factors That Affect Your Credit Score

Your credit score is influenced by several key factors. Understanding these can empower you to make informed financial decisions.

Sharkshop Payment history plays a significant role. Consistent, on-time payments signal reliability to lenders. Missing just one payment can cause a notable drop in your score.

Next up is credit utilization. This measures the amount of credit you’re using compared to your total available credit. Keeping this ratio below 30% helps maintain a healthy score.

The length of your credit history also matters. A longer history typically indicates experience with managing debt responsibly, which lenders favor.

Additionally, types of credit matter as well—having a mix, such as installments and revolving accounts, showcases your ability to handle various forms of debt effectively.

Lastly, new inquiries into your credit can have an impact too. Frequent applications for new accounts may suggest riskiness and could lower your score temporarily.

SharkShop’s Top Strategies for Boosting Your Credit Score:

Paying bills on time is crucial. Every missed payment can take a toll on your credit score. Set up reminders or automate payments to stay ahead.

Keeping your credit utilization low is another smart move. Aim to use less than 30% of your available credit at any given time. This shows lenders you’re responsible with credit management.

Disputing errors on your credit report can make a significant difference. Regularly check your reports for inaccuracies and file disputes when necessary. Correcting mistakes boosts credibility.

Building a mix of credit types also helps improve scores. Consider having both revolving accounts, like credit cards, and installment loans, such as car loans or mortgages.

Lastly, limit new credit applications. Each application triggers a hard inquiry that might lower your score temporarily, so be strategic about adding new lines of credit.

– Paying Bills On Time

Paying bills on time is one of the simplest yet most effective ways to enhance your credit score. Consistency in timely payments demonstrates financial responsibility to creditors and lenders.

Late payments can significantly harm your credit rating. Even a single missed payment can linger on your report for years. This makes punctuality crucial in maintaining a healthy score.

Set reminders or automate payments if you often forget due dates. Many banks offer tools that help you stay organized.

Additionally, consider breaking down larger bills into manageable amounts paid over time. This strategy reduces the risk of missing deadlines while keeping your finances steady.

Establishing a habit of paying bills early not only safeguards your credit score but also instills a sense of control over your financial situation.

– Keeping Credit Utilization Low

Keeping your credit utilization low is a vital component of managing your Sharkshop login credit score effectively. Credit utilization measures how much of your available credit you’re using at any given time. Ideally, aim to keep this figure below 30%.

When you maintain a lower ratio, it signals to lenders that you are responsible with borrowing. This can lead to better interest rates and loan offers in the future.

To achieve this, take a look at your spending habits. If you’re nearing that 30% threshold, consider paying down balances before the billing cycle closes or requesting an increase in your credit limit.

Remember, even if you have multiple cards, try not to max them out. Balancing usage across accounts helps keep overall utilization low while showcasing positive financial behavior. Small changes can yield significant benefits over time!

– Disputing Errors on Your Credit Report

Errors on your credit report can significantly impact your score. It’s crucial to check your report regularly for inaccuracies.

If you spot a mistake, act quickly. Gather any supporting documents that prove the error isn’t yours. This could be payment confirmations or correspondence with lenders.

Next, contact the credit bureau reporting the issue. You can do this online, by mail, or over the phone. Clearly explain what’s wrong and provide evidence of your claim.

The bureau must investigate within 30 days of receiving your dispute. They’ll reach out to the creditor involved and verify whether the information is accurate.

If they find an error, they’ll correct it on your report and send you a new copy. If not, don’t hesitate to ask them for details regarding their findings and consider disputing again if necessary. Remember: staying proactive about errors benefits you in the long run!

– Building a Mix of Credit Types

Having a variety of credit types can play a significant role in enhancing your credit score. Lenders favor borrowers who demonstrate they can manage different forms of credit responsibly.

Consider mixing revolving accounts, like credit cards, with installment loans such as mortgages or auto loans. This diversity shows that you’re capable of handling various financial obligations.

However, it’s essential to approach this strategy wisely. Opening new accounts solely for the sake of variety may negatively impact your score initially due to hard inquiries and decreased average account age.

Instead, focus on managing existing accounts well before seeking out new ones. A good mix not only boosts your score but also showcases your ability to handle debt appropriately across different platforms.

– Limiting New Credit Applications

When it comes to boosting your credit score, limiting new credit applications is crucial. Each time you apply for a new line of credit, a hard inquiry is recorded on your report. Too many inquiries can signal to lenders that you’re in financial distress.

Consider your needs before submitting an application. If you’re not sure whether you need a new card or loan, take some time to evaluate your options first.

Timing matters as well; multiple applications within a short period can have a compounding negative effect on your score. Instead, focus on building existing accounts and managing them efficiently.

Remember that quality outweighs quantity when it comes to credit. A few strong accounts reflect better than numerous weak ones scattered across different creditors. Prioritize thoughtful decisions over impulsive choices for optimal results in the long run.

How to Monitor and Track Your Progress with Your Credit Score

Monitoring your credit score is crucial for understanding where you stand financially. Start by checking your score regularly through trusted online platforms. Many services offer free access to your credit report, allowing you to keep tabs on any changes.

Set alerts for significant shifts in your score or updates on accounts. This proactive approach helps catch potential issues before they escalate.

Utilizing mobile apps can also simplify tracking progress. These tools often provide insights and tips tailored to improve your score based on current standings.

Consider maintaining a dedicated spreadsheet or journal documenting monthly scores and related activities. This visual representation of progress can be motivating.

Regularly reviewing factors impacting your credit—such as payment history and utilization rates—helps identify areas needing attention while reinforcing positive habits over time. Stay engaged with both the numbers and strategies that benefit you the most!

Additional Tips and Tricks for Improving Your Score

Improving your credit score doesn’t have to be a daunting task. Small changes can yield significant results.

Consider becoming an authorized user on someone else’s credit card. Sharkshop cc This could enhance your score if they maintain good habits.

Regularly review your financial statements for any subscriptions or payments you may have forgotten about. Eliminating unnecessary expenses can free up cash for timely bill payments.

Set reminders for payment due dates using apps or calendars to avoid late fees that impact your score negatively.

Diversifying your credit mix is another effective tactic. If you only have revolving accounts, think about adding an installment loan like a personal loan or auto financing, which shows lenders you’re capable of managing different types of debt responsibly.

Lastly, don’t shy away from negotiating with creditors for better terms that align with your budget and repayment capacity.

Alternatives to Traditional Credit Scores: What You Need to Know

As the financial landscape evolves, so do options for assessing creditworthiness. Traditional credit scores are just one piece of the puzzle. Alternatives are gaining traction and can provide a more comprehensive view of an individual’s financial health.

One such alternative is rent payment history. Many landlords now report on-time rent payments to credit bureaus, helping tenants build their score without traditional credit accounts.

Another option is using utility bill payments as part of your credit profile. Regularly paying utilities like gas or electricity shows reliability in managing ongoing expenses.

Peer-to-peer lending platforms also offer innovative scoring methods based on social data and behavior rather than just past borrowing patterns. This approach allows for a personalized assessment that may benefit those with thin files or no prior credit history.

Exploring these alternatives can empower consumers to showcase their financial responsibility beyond conventional metrics.

Conclusion: Take Control of Your Credit Score with SharkShop’s Strategies

Taking control of your credit score doesn’t have to be a daunting task. With SharkShop.biz proven strategies, you can boost your score and pave the way for better financial opportunities. By focusing on timely bill payments, maintaining low credit utilization, disputing any discrepancies in your report, diversifying your types of credit, and being mindful about new applications, you can steadily improve your standing.

Monitoring and tracking progress is crucial. Use available tools to keep an eye on changes in your score so you’re always aware of where you stand. Implement additional tips like setting reminders for payments or considering secured credit cards if needed.

Lastly, it’s important to remember that there are alternatives to traditional credit scores that may also benefit you in different financial scenarios. Understanding these options will empower you further as you navigate the world of credit.

Embrace these strategies with confidence and watch as they transform not just your credit score but also open doors to new possibilities in life with SharkShop by your side.