In recent years, the panorama of retirement savings has undergone important transformations, notably with the rise of other belongings like gold in Particular person Retirement Accounts (IRAs). The mixing of gold into retirement portfolios has become more and more standard as traders search to diversify their holdings and safeguard their wealth towards financial uncertainties. This text explores the demonstrable advances in the realm of IRA gold, highlighting improvements, regulatory modifications, and market dynamics that have shaped the current setting.

The Rising Attraction of Gold in IRAs

Gold has long been considered a safe-haven asset, especially during periods of financial instability. With inflation charges fluctuating and geopolitical tensions on the rise, many investors are turning to gold as a hedge against market volatility. The introduction of gold into IRAs permits people to incorporate bodily gold bullion and coins as a part of their retirement savings, providing a tangible asset that may potentially admire over time.

Regulatory Advances and Increased Accessibility

One of the notable developments on the earth of IRA gold is the regulatory framework that has developed to facilitate its inclusion in retirement accounts. The internal Income Service (IRS) has established clear guidelines regarding the types of gold that can be held in an IRA. This consists of specific requirements for purity and form, ensuring that solely excessive-quality gold is eligible for tax-advantaged retirement accounts.

In recent years, the IRS has additionally streamlined the process for opening and managing gold IRAs. Buyers are actually able to work with a growing number of custodians and directors who specialize in valuable metals. This increased accessibility has made it easier for individuals to benefit from gold investments inside their retirement portfolios.

Technological Improvements in Gold IRA Management

Advancements in know-how have additionally played a crucial function in the evolution of IRA gold administration. On-line platforms and digital instruments have emerged, permitting investors to simply monitor their gold investments, monitor market trends, and execute transactions with only a few clicks. These improvements have democratized access to gold investments, making it extra convenient for people to handle their retirement financial savings.

Furthermore, many custodians now provide educational sources and instruments that empower traders to make informed choices about their gold IRA investments. This contains market evaluation, value alerts, and insights into the efficiency of gold as an asset class. By leveraging expertise, investors are better outfitted to navigate the complexities of gold investing and optimize their retirement methods.

The Position of Gold in Diversification Methods

A key advantage of incorporating gold into an IRA is its means to boost diversification. Traditional retirement portfolios usually consist of stocks and bonds, which can be highly correlated throughout market downturns. Gold, then again, typically exhibits a detrimental correlation with equities, making it an effective device for danger management.

Recent research have proven that including gold to a diversified portfolio can enhance general returns whereas decreasing volatility. As investors turn into extra conscious of the significance of diversification, the demand for gold IRAs continues to rise. Financial advisors are increasingly recommending gold as a strategic asset in retirement planning, additional validating its position in modern investment methods.

Market Dynamics and Investor Sentiment

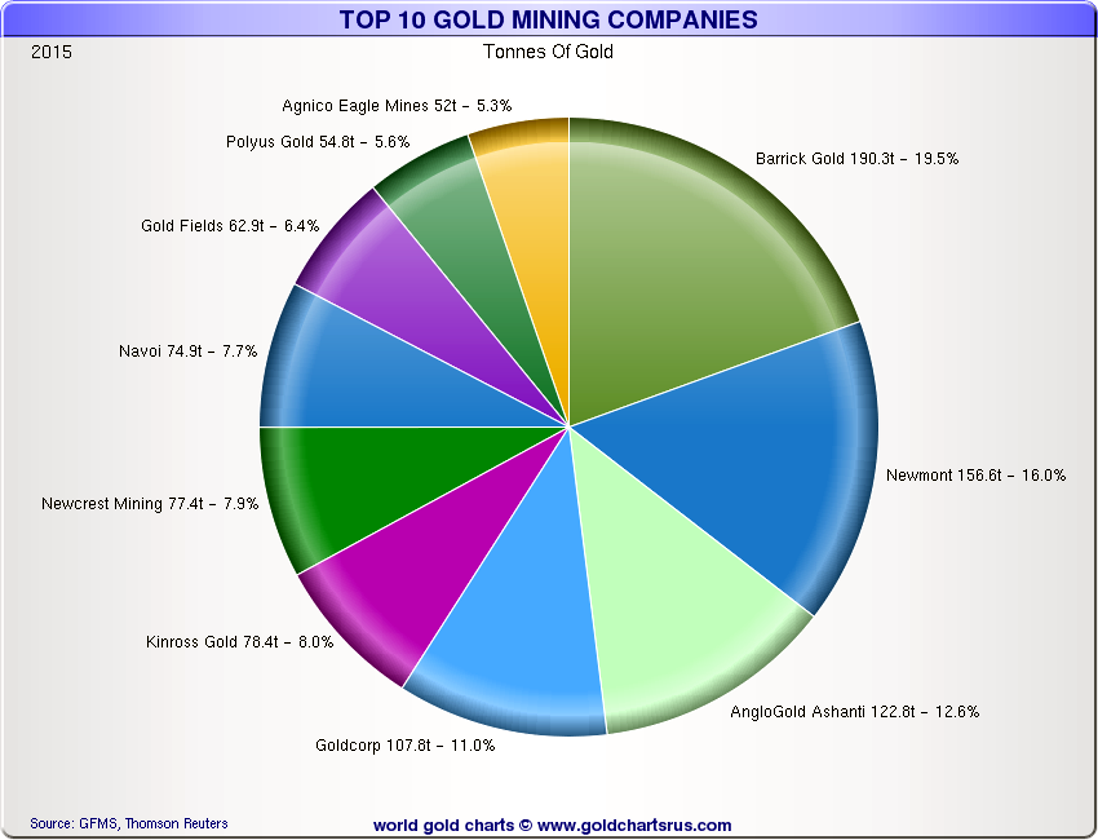

The current market dynamics surrounding gold have also contributed to its enchantment as an IRA funding. With central banks world wide adopting accommodative monetary insurance policies and increasing their gold reserves, investor sentiment towards gold has shifted positively. The perception of gold as a dependable retailer of value has been reinforced by its historical performance throughout financial downturns.

Additionally, the rise of inflationary pressures has prompted many traders to seek refuge in gold. As the cost of dwelling increases, the buying power of fiat currencies diminishes, main people to contemplate gold as a safeguard towards eroding wealth. This growing consciousness of top 10 gold ira companies reviews (https://irasgold.com)’s protective qualities has fueled curiosity in gold IRAs, as individuals look to secure their financial futures.

The future of IRA Gold Investments

Wanting ahead, the future of IRA gold investments appears promising. As extra people recognize the advantages of diversifying their retirement portfolios with treasured metals, the demand for gold IRAs is anticipated to grow. Moreover, ongoing innovations in the business, such as the development of new investment services and products, will possible improve the appeal of gold as a retirement asset.

Regulatory developments may even play an important function in shaping the way forward for IRA gold. As the IRS continues to refine its guidelines and set up clearer pathways for buyers, the marketplace for gold IRAs will possible grow to be even more strong. Additionally, as the global economy evolves, the role of gold as a hedge towards uncertainty will stay related, driving continued curiosity in gold investments.

Conclusion

In abstract, the landscape of IRA gold has skilled vital advancements in recent times, pushed by regulatory changes, technological innovations, and evolving market dynamics. As investors search to diversify their retirement portfolios and safeguard their wealth, gold has emerged as a compelling asset class. The integration of gold into IRAs not only provides people with a tangible investment but in addition enhances their general retirement strategy.

As we transfer ahead, the continuing evolution of IRA gold investments will proceed to current opportunities for individuals looking to safe their financial futures. With the mixture of increased accessibility, technological advancements, and a rising recognition of gold’s worth, the future of IRA gold seems to be vibrant. Buyers who embrace these advances and incorporate gold into their retirement plans might find themselves better outfitted to navigate the uncertainties of the financial landscape.