Vietnam’s energy landscape is in the midst of a major transformation. Over the past decade, the country has shifted from being a self-reliant coal producer to becoming one of the world’s top coal importers. The surge in Vietnam coal imports reflects the country’s rapid industrialization, rising electricity consumption, and structural changes in its energy sector.

In 2024, Vietnam imported coal worth $7.35 billion, marking a 6% increase from the previous year. The country ranked as the 6th largest coal importer globally, signaling its growing role in the international energy trade. According to Vietnam import data, the first four months of 2025 alone saw coal imports worth $2.52 billion, amounting to 24.44 million tons—an 18.8% year-on-year rise.

This remarkable growth is driven by the country’s industrial expansion, electricity demand, and reduced hydropower generation due to unpredictable weather conditions. As Vietnam coal imports soar, the nation is becoming a crucial player in the global energy market.

A Decade of Coal Growth: The Numbers Tell the Story

Over the last ten years, Vietnam coal imports have increased exponentially. From just $236 million in 2014, imports rose to over $7.35 billion in 2024—a more than thirtyfold increase. The trajectory underscores Vietnam’s deepening reliance on imported coal to sustain its fast-growing economy.

| Year | Vietnam Coal Import Value ($) |

|---|---|

| 2014 | $236.70 million |

| 2018 | $2.23 billion |

| 2020 | $3.59 billion |

| 2022 | $6.62 billion |

| 2024 | $7.35 billion |

| 2025 (Jan–Apr) | $2.52 billion |

In 2023, Vietnam imported around 51 million tons of coal; by 2024, this jumped to 63.8 million tons, a 25% year-on-year increase. Even as global coal prices fell from $130 to around $105 per ton, Vietnam’s total import bill climbed, highlighting the sheer scale of rising demand.

Who Supplies Vietnam’s Coal?

Vietnam coal imports are sourced from several major exporting nations, with three countries dominating the trade: Australia, Indonesia, and Russia.

-

Australia leads with $2.63 billion (35.9%) of Vietnam’s total coal imports. Its high-quality coal is essential for industrial use and electricity generation.

-

Indonesia follows with $2.34 billion (31.9%), offering affordable, medium-grade thermal coal ideally suited to Vietnam’s power plants.

-

Russia, with $913 million (12.4%), has rapidly expanded its share due to redirected exports from Europe to Asia.

Other contributors include South Africa, Mozambique, Laos, and the United States, each playing smaller yet strategic roles in ensuring supply diversity.

In 2024, Indonesia supplied roughly 27 million tons, or 43% of Vietnam’s total coal imports, while Australia contributed about 15 million tons, and Russia about 5 million tons.

This diversification not only enhances Vietnam’s energy security but also reflects the changing dynamics of the Vietnam imports market, where multiple suppliers compete to meet rising domestic demand.

Coal Importers Powering Vietnam’s Energy Sector

Several companies are at the forefront of Vietnam’s coal trade, managing large-scale import operations. According to Vietnam coal import data, leading importers include:

-

Vinacomin – Coal Import Export JSC – $450 million

-

Hoanh Son Group JSC – $350 million

-

Gain Lucky Vietnam Ltd. – $250 million

-

Vinacomex JSC – $180 million

-

Itochu Vietnam Co. Ltd. – $140 million

These importers are responsible for sourcing coal for both power generation and industrial use, ensuring continuous supply to thermal plants, cement factories, and steel manufacturers. Vinacomin, the state-owned mining giant, continues to dominate the sector, handling imports as part of its dual role in mining and energy logistics.

Why Vietnam Is Importing So Much Coal

1. Rising Electricity Demand

Vietnam’s electricity consumption has grown at 8–10% annually, driven by booming industrial zones, urban expansion, and export manufacturing. As GDP growth exceeded 7% in 2024, power demand surged beyond domestic production capacity, increasing dependence on imported coal.

2. Declining Hydropower Output

Irregular rainfall and droughts have cut hydropower output drastically in recent years. As a result, thermal power plants—fueled mainly by imported coal—have become the backbone of the energy grid.

3. Limited Domestic Coal Supply

Although Vietnam mines its own coal, domestic output has stagnated due to rising costs, environmental concerns, and logistical constraints. Imports now account for more than half of the country’s coal-fired power needs.

4. Favorable Market Conditions

Global coal prices softened through 2024, allowing Vietnam to import large quantities at lower costs. Indonesian and Malaysian coal, in particular, became highly competitive, reducing the overall import bill.

Vietnam Coal Imports by Type

In 2024, the composition of Vietnam coal imports highlighted the dominance of thermal coal for power generation:

| Coal Type | Import Volume (2024) | Import Value (2024) | Main Use |

|---|---|---|---|

| Thermal Coal | 44 million tons | $5.3 billion | Power generation |

| Coking Coal | 7 million tons | $1.2 billion | Steelmaking |

| Anthracite Coal | 6 million tons | $0.8 billion | Cement, chemicals |

| Other / Mixed Coal | 6 million tons | $0.3 billion | Industrial use |

The country’s growing coal-based energy demand ensures continued imports across multiple categories, making the sector an essential component of Vietnam’s industrial supply chain.

Vietnam Coal Imports vs. Exports

While Vietnam coal imports have skyrocketed, Vietnam coal exports remain modest, focusing primarily on anthracite coal shipments to regional markets like China and Japan. The contrast highlights a structural shift—Vietnam now imports low-grade and thermal coal for electricity but exports smaller volumes of high-quality anthracite.

This dual dynamic underscores the country’s evolving energy and trade profile, balancing Vietnam imports for industrial needs with Vietnam exports to maintain foreign trade earnings.

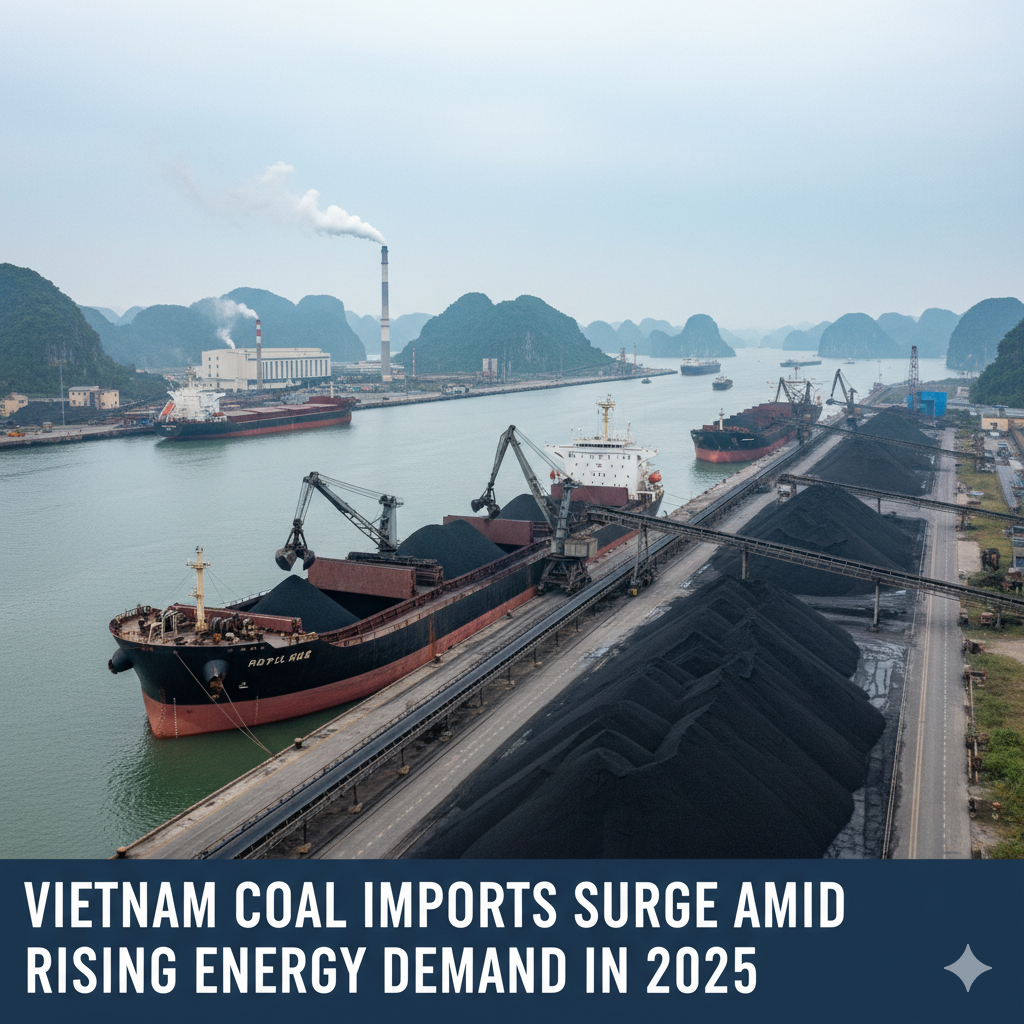

Ports and Infrastructure: The Coal Gateways

The Quang Ninh Province serves as Vietnam’s main coal import hub, handling over 70% of the country’s incoming coal shipments. Ports like Cai Lan and Cam Pha are critical nodes connecting Vietnam to Indonesian and Australian exporters.

In southern Vietnam, ports such as Vung Tau and Duyen Hai are expanding capacity to support rising industrial energy demand. The government continues investing in port infrastructure to avoid logistical bottlenecks as Vietnam coal imports continue to grow.

Outlook: What’s Next for 2025 and Beyond

Looking ahead, Vietnam coal imports are expected to remain strong. Projections indicate that between 2025 and 2035, annual import demand could range from 50 to 83 million tons, depending on economic and energy trends.

By 2030, coal could still supply around 40% of Vietnam’s electricity generation, even as renewables and LNG capacity increase. However, over-reliance on imported coal presents risks—ranging from price volatility to geopolitical supply shocks.

Environmental concerns also loom large. Under the Just Energy Transition Partnership (JETP), Vietnam has pledged to reduce emissions intensity, posing long-term challenges for its coal-heavy energy mix. Still, in the near term, coal remains indispensable to sustaining economic growth and industrial production.

Conclusion: Coal Remains Vietnam’s Power Backbone

The surge in Vietnam coal imports marks a defining chapter in the country’s energy journey. With domestic production plateauing and demand continuing to rise, imports from Indonesia, Australia, and Russia will remain vital for powering Vietnam’s industrial economy.

Falling prices, rising consumption, and expanding infrastructure have made coal the cornerstone of Vietnam’s energy security. Yet, as the nation looks ahead, balancing energy needs with environmental commitments will be the ultimate test.

For now, coal continues to dominate the conversation—solidifying Vietnam’s position as a major player in the global energy market.